Your Cash app venmo paypal images are ready. Cash app venmo paypal are a topic that is being searched for and liked by netizens now. You can Download the Cash app venmo paypal files here. Download all free vectors.

If you’re looking for cash app venmo paypal pictures information related to the cash app venmo paypal interest, you have pay a visit to the right site. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

Cash App Venmo Paypal. But cash app does have many benefits like being able to use it like a bank account. Cash back is in fashion. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. Cash app, paypal and venmo must now report transactions totaling $600 to the irs our current president joe biden may not be the average man or small business owner’s friend many believed he could have been in the last presidential election (or that he promised he would be).

Everything You Need to Know About PayPal, Square Cash and From vox.com

Everything You Need to Know About PayPal, Square Cash and From vox.com

January 4, 2022, 2:19 pm. A cash app user can also add their bank card so that they are able to transfer money through the cash app without purchasing from cash. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. Apple pay cash by mark jansen , christian de looper and paula beaton july 5, 2021 share money makes the world go ’round. This makes your account appear like the ordinary bank accounts which have the. Cash app, paypal and venmo must now report transactions totaling $600 to the irs our current president joe biden may not be the average man or small business owner’s friend many believed he could have been in the last presidential election (or that he promised he would be).

A cash app user can also add their bank card so that they are able to transfer money through the cash app without purchasing from cash.

The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. New year, new tax laws. A cash app user can also add their bank card so that they are able to transfer money through the cash app without purchasing from cash. Millions of small business owners who rely on payment apps like venmo, paypal and cash app could be subject to a new tax law that just took effect in january. Venmo, paypal, cash app must report payments of $600 or more to the irs.

Source: etsy.com

Source: etsy.com

You can receive direct deposits, invest, and even trade cryptocurrency in your cash. Whether you owe a friend. New year, new tax laws. This makes your account appear like the ordinary bank accounts which have the. The payment wallets allow you to link them to your credit cards and bank accounts.

Source: considerable.com

Source: considerable.com

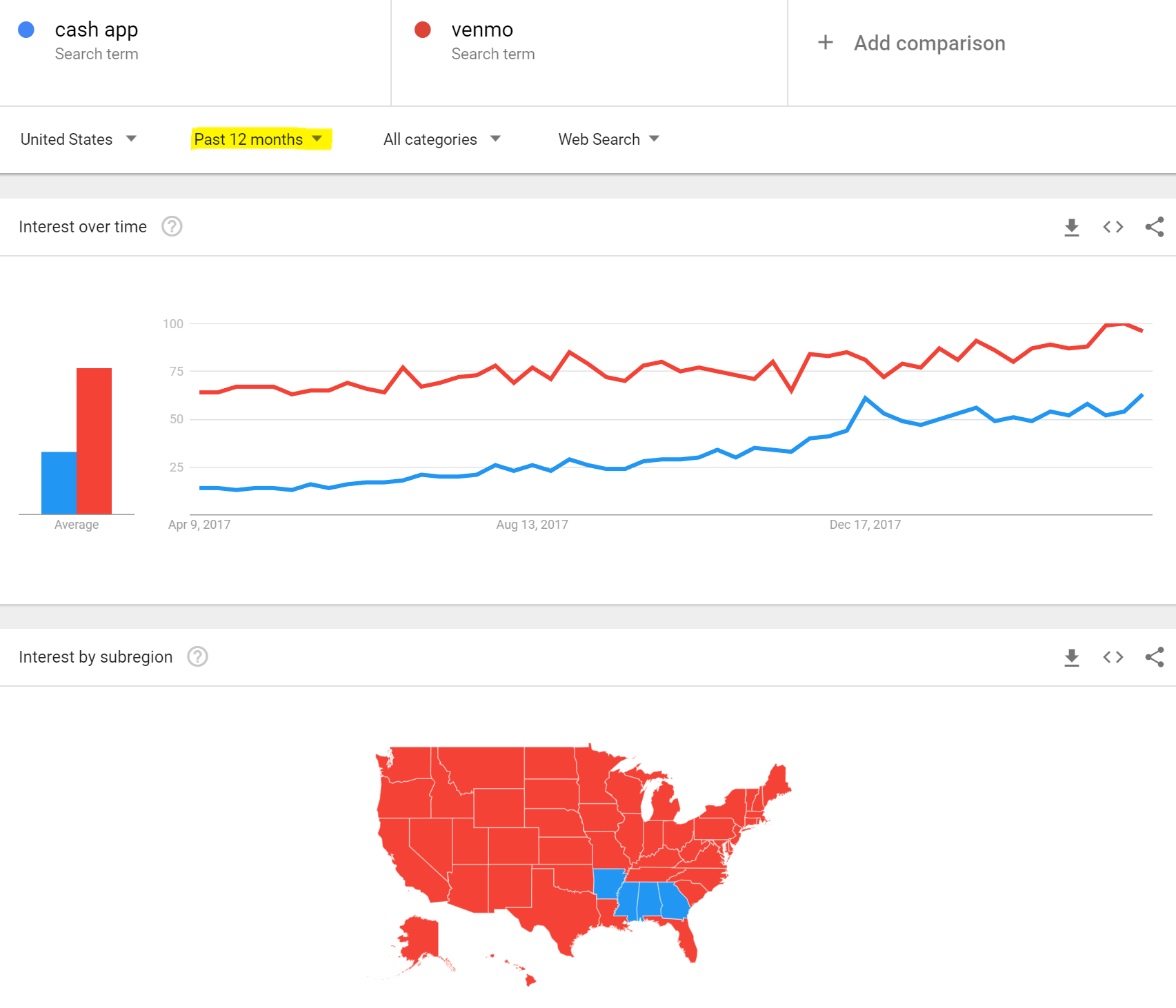

Cash app was launched as square cash in 2013. Get $25 cash back at bloomingdale�s. January 4, 2022, 2:19 pm. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. Cash app was started by square in 2013 and venmo was started in 2009 by paypal.

Source: pinterest.com

Source: pinterest.com

Millions of small business owners who rely on payment apps like venmo, paypal and cash app could be subject to a new tax law that just took effect in january. Get $25 cash back at bloomingdale�s. But cash app does have many benefits like being able to use it like a bank account. The payment wallets allow you to link them to your credit cards and bank accounts. Cash app was started by square in 2013 and venmo was started in 2009 by paypal.

Source: choq.fm

Source: choq.fm

A cash app user can also add their bank card so that they are able to transfer money through the cash app without purchasing from cash. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. It also recently acquired credit karma and will be adding it to the app. For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law. This makes your account appear like the ordinary bank accounts which have the.

Source: youtube.com

Source: youtube.com

Square�s cash app includes a partially updated page for users with cash app for business. A cash app user can also add their bank card so that they are able to transfer money through the cash app without purchasing from cash. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. This makes your account appear like the ordinary bank accounts which have the. You can receive direct deposits, invest, and even trade cryptocurrency in your cash.

Source:

Source:

The new reporting requirement only applies to sellers of goods and. 1, mobile payment apps like venmo, paypal and cash app are required to report commercial transactions totaling more than $600 per year to the internal revenue service. The greatest number of people using apps such as venmo, cash app, paypal, facebook pay, and so on are among the generation y cohort. A cash app user can also add their bank card so that they are able to transfer money through the cash app without purchasing from cash. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher.

Source: ideundangan.com

Source: ideundangan.com

Cash back is in fashion. Cash app was launched as square cash in 2013. Apple pay cash by mark jansen , christian de looper and paula beaton july 5, 2021 share money makes the world go ’round. Cash app, paypal and venmo must now report transactions totaling $600 to the irs our current president joe biden may not be the average man or small business owner’s friend many believed he could have been in the last presidential election (or that he promised he would be). On january 1, a provision of the american rescue.

Source: marketwatch.com

Source: marketwatch.com

1, mobile payment apps like venmo, paypal and cash app are required to report commercial transactions totaling more than $600 per year to the internal revenue service. This makes your account appear like the ordinary bank accounts which have the. Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. The new reporting requirement only applies to sellers of goods and. Apple pay cash by mark jansen , christian de looper and paula beaton july 5, 2021 share money makes the world go ’round.

Source:

Source:

Whether you owe a friend. For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law. Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. It also recently acquired credit karma and will be adding it to the app. A cash app user can also add their bank card so that they are able to transfer money through the cash app without purchasing from cash.

Source: digitaltrends.com

Source: digitaltrends.com

It also recently acquired credit karma and will be adding it to the app. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. Paypal, which owns venmo, is offering similar guidance for users of its app, a company spokesperson said. But cash app does have many benefits like being able to use it like a bank account.

Source: money.com

Source: money.com

Paypal, which owns venmo, is offering similar guidance for users of its app, a company spokesperson said. Cash app, like venmo, is for sending money between friends. If a check is approved, the deposited funds are available within minutes. Apple pay cash by mark jansen , christian de looper and paula beaton july 5, 2021 share money makes the world go ’round. Under the new tax law that took.

Source: ascend.org

Source: ascend.org

You can receive direct deposits, invest, and even trade cryptocurrency in your cash. Under the new tax law that took. But cash app does have many benefits like being able to use it like a bank account. Cash app was launched as square cash in 2013. It also recently acquired credit karma and will be adding it to the app.

Source: digitaltrends.com

Source: digitaltrends.com

Cash back is in fashion. 1, mobile payment apps like venmo, paypal and cash app are required to report commercial transactions totaling more than $600 per year to the internal revenue service. This makes your account appear like the ordinary bank accounts which have the. Under the new tax law that took. The new reporting requirement only applies to sellers of goods and.

Source: seekingalpha.com

Source: seekingalpha.com

Cash app has a cash card that acts as a debit card. Cash app, paypal and venmo must now report transactions totaling $600 to the irs our current president joe biden may not be the average man or small business owner’s friend many believed he could have been in the last presidential election (or that he promised he would be). 1, mobile payment apps like venmo, paypal and cash app are required to report commercial transactions totaling more than $600 per year to the internal revenue service. This makes your account appear like the ordinary bank accounts which have the. On january 1, a provision of the american rescue.

Source: cashappreferral.com

Source: cashappreferral.com

January 4, 2022, 2:19 pm. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. You can receive direct deposits, invest, and even trade cryptocurrency in your cash. The internal revenue service (irs) is cracking down on payments. 1, mobile payment apps like venmo, paypal and cash app are required to report commercial transactions totaling more than $600 per year to the internal revenue service.

Source: news.yahoo.com

Source: news.yahoo.com

1, mobile payment apps like venmo, paypal and cash app are required to report commercial transactions totaling more than $600 per year to the internal revenue service. New year, new tax laws. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. Cash app was started by square in 2013 and venmo was started in 2009 by paypal. Recently, venmo rolled out a new cash a check feature that lets users deposit a check into their venmo account by taking a picture of it with the venmo app.

Source: gizmodo.com

Source: gizmodo.com

Millions of small business owners who rely on payment apps like venmo, paypal and cash app could be subject to a new tax law that just took effect in january. The payment wallets allow you to link them to your credit cards and bank accounts. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. Paypal, which owns venmo, is offering similar guidance for users of its app, a company spokesperson said. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says.

Source: usatoday.com

Source: usatoday.com

Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. The payment wallets allow you to link them to your credit cards and bank accounts. But cash app does have many benefits like being able to use it like a bank account. Venmo, paypal, cash app must report payments of $600 or more to the irs. For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cash app venmo paypal by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.