Your Venmo cash app zelle images are ready. Venmo cash app zelle are a topic that is being searched for and liked by netizens now. You can Download the Venmo cash app zelle files here. Find and Download all free images.

If you’re looking for venmo cash app zelle images information linked to the venmo cash app zelle interest, you have come to the right site. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

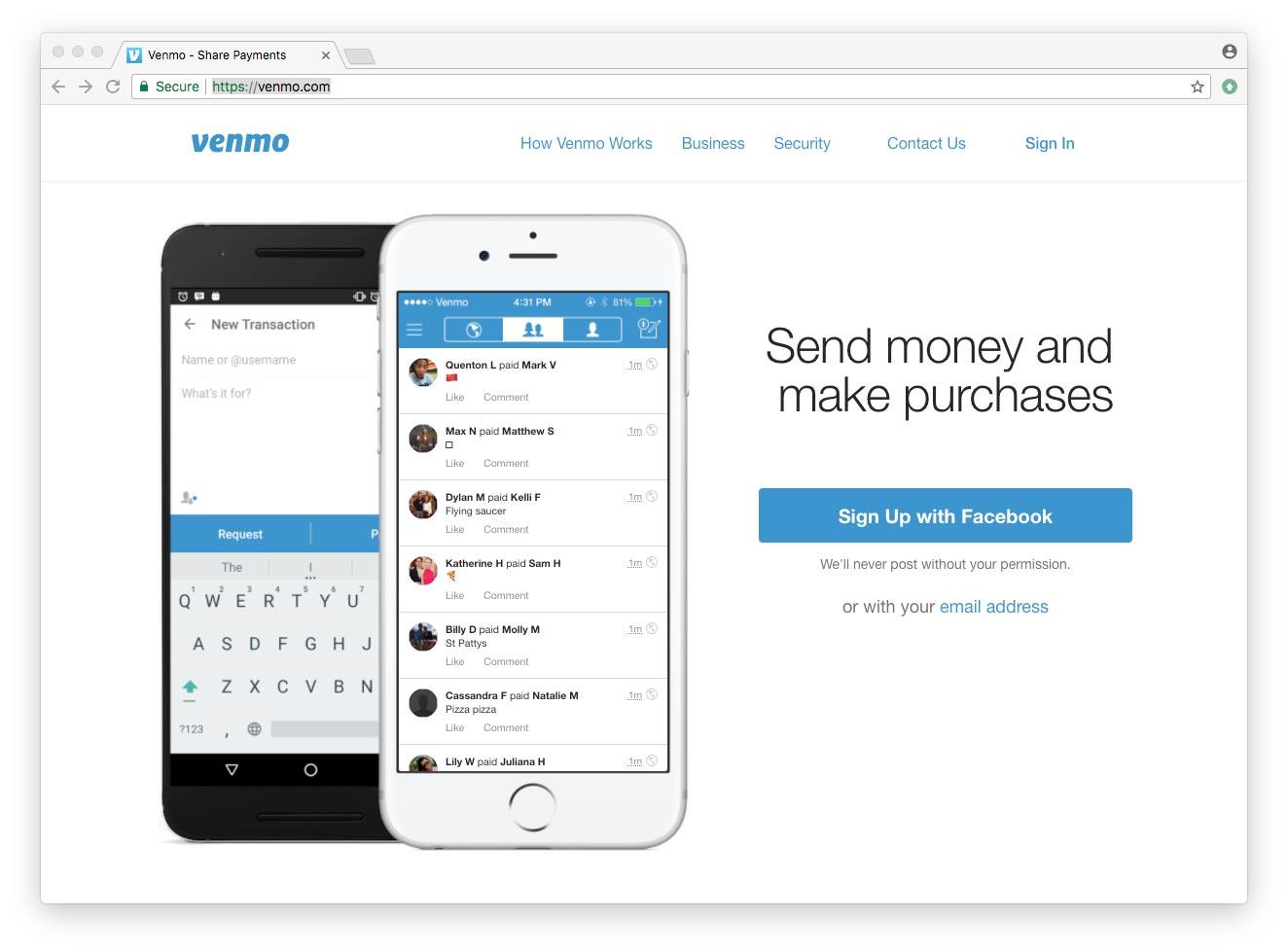

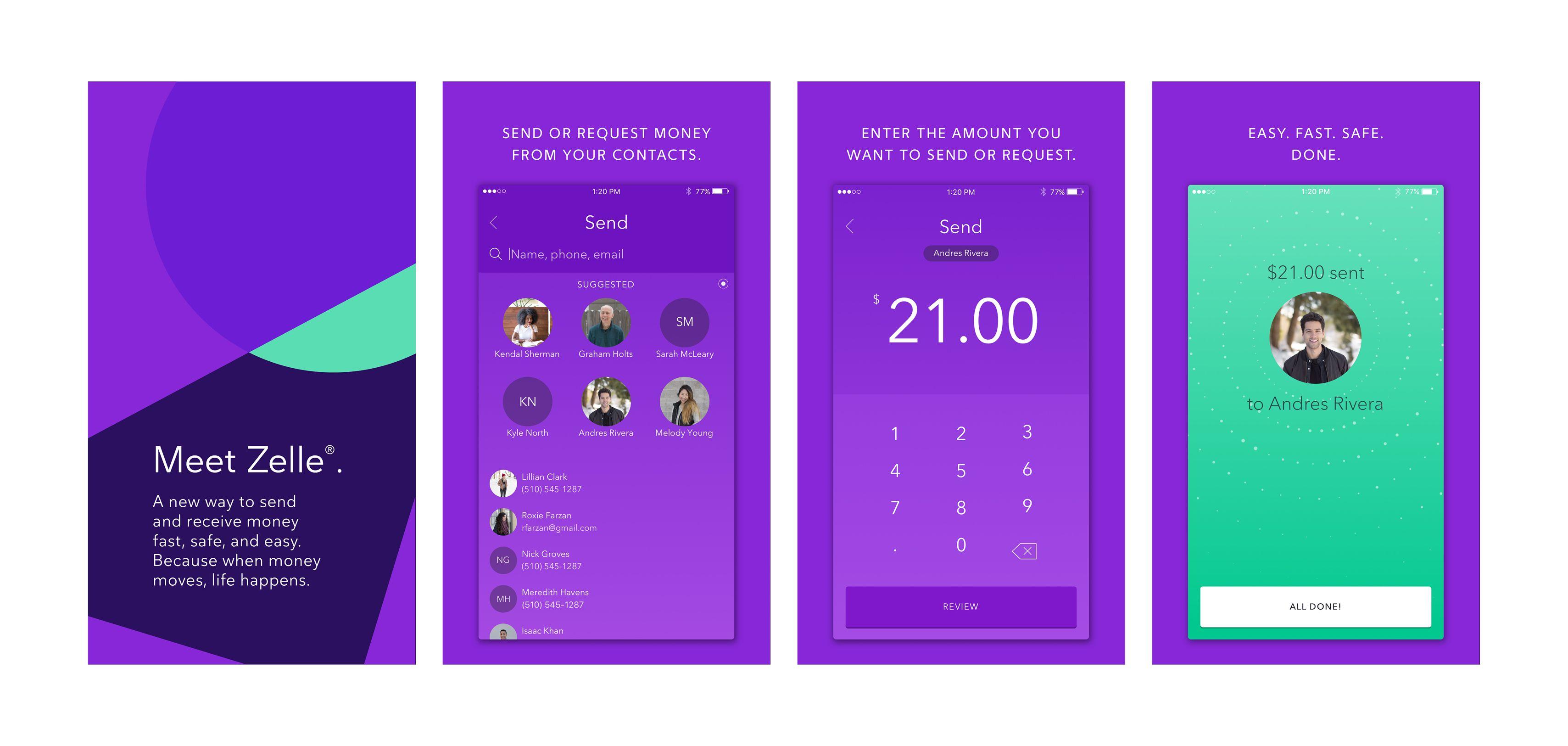

Venmo Cash App Zelle. Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. The choice between zelle and venmo boils down to what you want a cash app to do for you—with venmo being more robust than zelle—and whether you’d rather pay no fees at all (zelle) or you. The zelle app is already a feature within existing bank apps. The new reporting requirement only applies to sellers of goods and.

Venmo, Zelle and Cash App are tops in mobile peertopeer From 9news.com

Venmo, Zelle and Cash App are tops in mobile peertopeer From 9news.com

Cash app, like venmo, is for sending money between friends. Online banking customers who have accounts at participating banks can send money to anyone. But cash app does have many benefits like being able to use it like a bank account. You can receive direct deposits, invest, and even trade cryptocurrency in your cash. Zelle continued… venmo and cash app let you keep money in your account balance, while zelle does not store it in your account. This mobile payment service is owned by paypal, and it is considered to be the most popular p2p transfer app worldwide.

New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says.

If we compare cash app to zelle and venmo then it is most similar to venmo in the sense that users will create a virtual usd bank account on registration. More than 60 million people use the venmo app for fast, safe, social payments. You can receive direct deposits, invest, and even trade cryptocurrency in your cash. Cash app was launched as square cash in 2013. Whereas other mobile payment apps like venmo and zelle cater more to the transfer of funds from one. The choice between zelle and venmo boils down to what you want a cash app to do for you—with venmo being more robust than zelle—and whether you’d rather pay no fees at all (zelle) or you.

Source: money.com

Source: money.com

1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs. The irs is not taxing transactions between family or friends, which is how most people use venmo and zelle. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. Whereas other mobile payment apps like venmo and zelle cater more to the transfer of funds from one. If we compare cash app to zelle and venmo then it is most similar to venmo in the sense that users will create a virtual usd bank account on registration.

Source:

Source:

Cash app, like venmo, is for sending money between friends. But cash app does have many benefits like being able to use it like a bank account. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account. Venmo, cash app and zelle now required to report transactions over $600 to irs and users are upset.

Source: logodix.com

Source: logodix.com

Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account. Use it as a cash. Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. This setup is a good thing. Cash app was launched as square cash in 2013.

Source: youtube.com

Source: youtube.com

Bottom line — for most zelle, venmo, and cash app users, there is really no change. Venmo’s platform features a more social feel, allowing users to share messages detailing what they’ve spent their. Tempting to offer these alternatives to accept rent payments from zelle, venmo, and cashapp but are these services the best way to collect rent. How does cash app work? If we compare cash app to zelle and venmo then it is most similar to venmo in the sense that users will create a virtual usd bank account on registration.

Source: logodix.com

Source: logodix.com

The new reporting requirement only applies to sellers of goods and. Bottom line — for most zelle, venmo, and cash app users, there is really no change. Use it as a cash. Online banking customers who have accounts at participating banks can send money to anyone. This mobile payment service is owned by paypal, and it is considered to be the most popular p2p transfer app worldwide.

Source: fox6now.com

Source: fox6now.com

Tempting to offer these alternatives to accept rent payments from zelle, venmo, and cashapp but are these services the best way to collect rent. The zelle app is already a feature within existing bank apps. Venmo is a digital wallet that makes money easier for everyone from students to small businesses. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. Use it as a cash.

Source: youtube.com

Source: youtube.com

Cash app has the most functionality of all the p2p networks and eventually, square thinks cash app could do just about everything a traditional bank does for most people. Venmo is a digital wallet that makes money easier for everyone from students to small businesses. In those services, you carry a balance until you�re ready to cash out, which is a process that takes a few days unless you pay a fee. In other words, the cash app incentivizes users to hold a balance and invest with the app itself. Bottom line — for most zelle, venmo, and cash app users, there is really no change.

Source: logodix.com

Source: logodix.com

As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. The irs is requiring mobile payment apps such as zelle, block inc.�s (nyse: This mobile payment service is owned by paypal, and it is considered to be the most popular p2p transfer app worldwide. While it�s likely that zelle�s policies will be altered in similar ways to venmo�s and paypal�s, the platform declined to say anything specific enough to reassure users. This setup is a good thing.

Source: usatoday.com

Source: usatoday.com

The irs is not taxing transactions between family or friends, which is how most people use venmo and zelle. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. Zelle also puts that book or birthday money in your account instantly, unlike venmo and cash app. Unlike venmo, zelle offers you an option to send money to a small business account. Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account.

Source: cleveland.com

Source: cleveland.com

But cnet, in an analysis of the new law, says for zelle, venmo, and cash app users who use the services simply to transfer money between family and friends, there will be no change. Updated 11:14 am et, mon january 24, 2022. Whereas other mobile payment apps like venmo and zelle cater more to the transfer of funds from one. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. By jeanne sahadi, cnn business.

Source: 9news.com

Source: 9news.com

Venmo is a digital wallet that makes money easier for everyone from students to small businesses. But cnet, in an analysis of the new law, says for zelle, venmo, and cash app users who use the services simply to transfer money between family and friends, there will be no change. If we compare cash app to zelle and venmo then it is most similar to venmo in the sense that users will create a virtual usd bank account on registration. Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account. Zelle continued… venmo and cash app let you keep money in your account balance, while zelle does not store it in your account.

Source:

Source:

This app is primarily aimed at young people. Venmo’s platform features a more social feel, allowing users to share messages detailing what they’ve spent their. Zelle also puts that book or birthday money in your account instantly, unlike venmo and cash app. This app is primarily aimed at young people. Online banking customers who have accounts at participating banks can send money to anyone.

The irs is not taxing transactions between family or friends, which is how most people use venmo and zelle. If we compare cash app to zelle and venmo then it is most similar to venmo in the sense that users will create a virtual usd bank account on registration. It also recently acquired credit karma and will be adding it to the app. In those services, you carry a balance until you�re ready to cash out, which is a process that takes a few days unless you pay a fee. The venmo app uses encryption to keep your data safe and also allows you to add a pin.

Source: logodix.com

Source: logodix.com

More than 60 million people use the venmo app for fast, safe, social payments. The irs is not taxing transactions between family or friends, which is how most people use venmo and zelle. The choice between zelle and venmo boils down to what you want a cash app to do for you—with venmo being more robust than zelle—and whether you’d rather pay no fees at all (zelle) or you. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. It also recently acquired credit karma and will be adding it to the app.

How does cash app work? This mobile payment service is owned by paypal, and it is considered to be the most popular p2p transfer app worldwide. Unlike venmo, zelle offers you an option to send money to a small business account. Tempting to offer these alternatives to accept rent payments from zelle, venmo, and cashapp but are these services the best way to collect rent. It also recently acquired credit karma and will be adding it to the app.

Source: logodix.com

Source: logodix.com

In cash app, instant deposits cost 1.5% of the total amount. Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account. Venmo’s platform features a more social feel, allowing users to share messages detailing what they’ve spent their. The venmo app uses encryption to keep your data safe and also allows you to add a pin. In cash app, instant deposits cost 1.5% of the total amount.

Source: abc27.com

Source: abc27.com

By jeanne sahadi, cnn business. This app is primarily aimed at young people. If we compare cash app to zelle and venmo then it is most similar to venmo in the sense that users will create a virtual usd bank account on registration. Cash app has the most functionality of all the p2p networks and eventually, square thinks cash app could do just about everything a traditional bank does for most people. The zelle app is already a feature within existing bank apps.

Source: choq.fm

Source: choq.fm

The irs is requiring mobile payment apps such as zelle, block inc.�s (nyse: Zelle also puts that book or birthday money in your account instantly, unlike venmo and cash app. Cash app has the most functionality of all the p2p networks and eventually, square thinks cash app could do just about everything a traditional bank does for most people. Venmo’s platform features a more social feel, allowing users to share messages detailing what they’ve spent their. Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title venmo cash app zelle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.